Life insurance refers to the legally binding contract between a policyholder and an insurance company that provides financial protection to his/her family. The insurer promises to offer the insurance benefit in exchange for regular premiums paid by the life insured. The 'financial protection' under life insurance is provided in the form of life cover, also known as sum assured. It is a pre-agreed amount that is payable in case of an untoward incident with the life insured. Birla sun life insurance is one of the best insurer for term insurance policy plan. The policy coverage is 93% and the claims are good even the the claiming procedure is easy because the service provided by the company members are good and even the web services are even better.

The premiums are low and for women 5% less extra benefits. Our reviews of life insurance companies are based on a quantitative methodology that analyzes each insurer on their stability and reliability, customer service, claims experience, diversity of product lines, and cost. We compare the terms of each type of policy offered—including available coverage amounts, optional riders, and premium payment options—with those of other major life insurance companies. Lastly, we look at how the company is rated by third-party organizations to determine its reliability and overall reputation.

I purchased birla sun life insurance policy and the product is term insurance policy plan. Service facilitate by executives and staff members are very nice and fast. The policy saves taxes and it is really very good investment for future.

This concept applies to life insurance policies and guaranteedreturn insurance policies. These plans give you secure life insurance coverage along with an element of savings to help you meet your life goals. A guaranteed1 return insurance plan offers you assured returns in the mode of your choice. You can opt to take returns from your plan as a lump sum, regular income or a whole life income benefit. The plan also offers guaranteed1 insurance cover to protect those you love the most in the world – your family. I buy term insurance policy plan from birla sun life insurance.

The policy coverage is 80% and the premiums are low ~25 K per year. The claims are easily sanctioned because the services are fast from the executives side and from online web services also. Policy coverage is 90% and the claims are sanctioned easily form the insurance department. Term insurance plan which i purchased from birla sun life insurance.

The policy coverage is high and service provided by the executives and members of the company is great. Term insurance plans are plans designed to meet the income protection need of individuals who want to create a corpus for their families in the event of their untimely demise. The plan offers benefits to the policyholder's family in case of death and costs very little. No other benefit is provided in case of maturity though some term plans do offer the premiums paid over the course of the tenure to the policyholder if he survives till maturity but such plans are priced higher. The Assured Savings Plan offers the flexibility to tailor one's diverse savings and protection needs across life phases. This personalised savings plan provides fully guaranteed benefits on death or maturity, along with the convenience of customizing the plan benefits as per the customer's desired milestones.

The plan offers varied choices such as joint-life protection, multiple premium payment term options, flexible policy term and rider options, to help design a unique resolution for the policyholders and their family members. ABSLI Assured Savings Plan offers the flexibility to tailor one's diverse savings and protection needs across life phases. This hyper-personalized savings plan provides fully guaranteed benefits on death or maturity, along with the convenience of customizing the plan benefits as per the customer's desired milestones.

How To Read Sun Life Assure Card The plan offers varied choices such as, joint life protection, multiple premium payment term options, flexible policy term and rider options, to help design a unique resolution for the policyholders and their family members. With the right sum assured for your insurance cover, you can secure the financial future of your family in case of your absence. You also have an option to enhance your guaranteed1 insurance policy through add-on riders. Further, this guaranteed1 return insurance plan gives you the freedom to pay all premiums in a lump sum, regularly or for a limited period. Most life insurance policies ask for long-term commitment to pay the premium timely and help create wealth, which can be used to fulfil various life goals. You can also opt for life insurance plans with maturity benefits to enjoy life with financial independence.

When you refer to the life insurance quotes for your financial profile, you will get a clearer overview of how this will work. The policy provide benefits according to premiums, so the term policy plan which i buy from birla sun life insurance is fair deal. Policy coverage is 70% and the claims are little bit low as the premiums are low. Around 23 L is the returns and the online portal is good and respond well.

The policy coverage is good about 81% and the claims are high. The services are fast and the claims are easily sanctioned. ABSLI Income Assured Plan is a savings plan that allows the policyholder to plan his/her long-term future goals . The plan allows the flexibility to choose from 2 options (monthly & lump sum) to receive the assured income at the end of the premium payment term. The plan also provides a number of riders at nominal prices to enhance the existing coverage.

ABSLI SecurePlus Plan offers guaranteed income benefit payouts at the end of each policy year. The payouts are a predetermined percentage of annual paid premiums towards the policy. The plan comes out with various rider options to enhance life insurance coverage. Aditya Birla Sun Life Insurance Company Limited or ABSLI, formerly known as Birla Sun Life Insurance Co. Ltd. started its operations on January 17th, 2001 in India.

The company is a joint venture between Aditya Birla Group, a sincere multinational enterprise with a global presence and Sun Life Financial Inc., one of Canada's top financial service organizations. It is also currently ranked among the top seven companies in Individual Business (Individual FYP amended for 10% single premium) in India. Birla sun life insurance is equally good as other insurers for term insurance policy plan. The policy coverage is high with high claims and the claiming part is easy and no paper work so no waiting.

Friend of mine suggested me a term insurance policy which I bought from birla sun life insurance company ltd. Service is absolutely fantastic which is facilitated by the whole term of the insurance company. The renewals are made easy through the service of online portal service. Term life insurance is a good option for young and healthy individuals or families who want affordable coverage. Term life insurance provides coverage for a certain number of years and has level premiums and a guaranteed death benefit. If the policyholder passes away during the term, their beneficiaries receive the death benefit.

If they outlive the term, they sometimes have the option to convert their term policy into a permanent policy, otherwise, the coverage ends when the term ends. Established in the year 2000, Aditya Birla Sun Life Insurance Company Limited is one of the most reputed private insurers operating in India. The company functions as a subsidiary of Aditya Birla Capital and continues to provide life insurance service to its customers. The company has a strong product line up that comprises term plans, endowment plans, money-back policies, retirement plans, child plans, etc. The company offers a mix of both online and offline plans for its customers.

For offline plans, customers have to visit a branch office and consult with an officer before purchasing a policy. Let's take a detailed look at various attributes of the company. With the help of this plan, you can develop a disciplined habit of savings and save time on management of investments in the market. You will be liable to get a whole life cover under the plan with limited premium payment term options. The plan offers the flexibility to choose from 3 investment options to suit your investment needs.

These life insurance plans are meant for organizations or groups to provide life cover to the employees or group members, respectively. Through group insurance plans, the employers tend to take care of the financial security of their employees' family, thus motivating them to work harder to maintain high-performing businesses. Keeping this cover in mind, you can check the life insurance quotes for additional financial security for your loved ones.

A Unit Linked Insurance Plan or ULIP is a unique form of life insurance. It provides life cover while also allowing you to invest money in market-linked instruments. By investing in ULIPs, you get the benefits of market linked returns over the long term, life cover, income tax savings, and flexibility to switch between funds. The life insurance quotes will enable you to determine the amount required for financial security and investment purposes, so that you can divide it efficiently. Birla sun life insurance term policy plan i buy in low premiums and the policy coverage is 95% with good claims.

The service is great provided by the executives and the 5% less on premiums for women. My term policy plan is with birla sun life insurance policy plan. Claims are easily sanctioned because of the quick services.

The amount of payback is Rs.23 L. I'm satisfied with this policy plan. Searching for life insurance and finally got one from birla sun Life Insurance one of the best insurance company. Recently i have purchased term insurance policy through birla sun life insurance. I recently bought a aditya birla sun life term insurance policy from the policybazaar.

It is a nice product and has helped me in securing my family's future. I have recently bought a term insurance plan from the policybazaar. It was of aditya birla sun life insurance and that plan is superb. I have recently got the term insurance plan from the website of the policybazaar.

This company is good and have been providing with a lot of better services to me and my family. On its website, Sun Life mentions that it offers a guaranteed issue life insurance policy. Guaranteed issue coverage doesn't require a medical exam, so anyone who applies can get approved, regardless of their health.

Guaranteed issue policies are usually more expensive than regular whole life or term life insurance because the underwriter has to assume more risk in the absence of a medical exam. Yes, Aditya Birla Sun Life Insurance offers plans for NRIs also. NRIs can get financial solutions through Vision LifeIncome Plan. Policyholders get survival benefits each year from the end of the term of paying the premium to the date of maturity.

ABSLI Vision Endowment Plus Plan is a savings plus protection plan that safeguards the family against unforeseen circumstances. The plan offers a return of premiums along with maturity and death benefit in case of an unfortunate demise of the life assured. It also offers accrued regular bonuses and terminal bonus after the completion of the policy tenure.

These plans are life insurance products that provide financial security for your retirement days. These life insurance plans help you invest money during the working years and create a corpus that you can use as a whole or in parts to fund your retired life. You can think of investing in retirement plans as a disciplined way to plan for the golden years of life. For life insurance plans with a return of premium option, the insured gets the total of all premiums paid back if insured person survives the policy term, which can be used to achieve several life goals. As per the life insurance contract, the insurers promise to pay a pre-decided amount to the life insured or policy nominee provided the insured pays the premium without fail. In other words, all the benefits that you can get under a life insurance policy are based on the timely premium payment.

ABSLI Child's Future Assure is a life insurance and savings plan that provides you with guaranteed benefits to assist you to cover major life events such as schooling and marriage expenditures for your child. If you make regular premium payments, you will get a 20% loyalty bonus, which will be added to the guaranteed benefit at each scheduled distribution. My term insurance plan is very good and returns are much more than investment. Policy coverage is fantastic and claims are easily sanctioned due to superb service provided by the company members. Birla Sun life insurance company is good insurers and they provide wide range of insurance policies. Claiming amount is big which is sanctioned when the policy get matured.

Online portal is for online renewals of the insurance policies. The term insurance which I bought from the birla sun life insurance is one of the best plan I have got. I really like the offers and the plans are really beneficial for me and my family. The company is not looking to raise any funds urgently as it is currently well placed with business in the first quarter of the financial year being in a good condition. It is now focusing on products that have both protection and guarantee. During these challenging times, two products were launched by the company, which were ABSLI Assured Flexisavings Plan and ABSLI Child's Future Assured Plan.

The plan is to achieve around 15% to 29% growth by the end of this financial year. In the first quarter of FY , the gross premium income was Rs.1,6896 crore. Approximately 71% of premiums were renewed through digital channels this year.

Death claims were lower during the first quarter of this financial year. The company has also received a total of 69 claims for Covid-19 treatments so far which is 2% of the overall claims. Sun Life is an average life insurance company, and we wouldn't recommend it. The company is not transparent in terms of its coverage options, there are only two riders available, the customer support is limited, and the online user experience is not great.

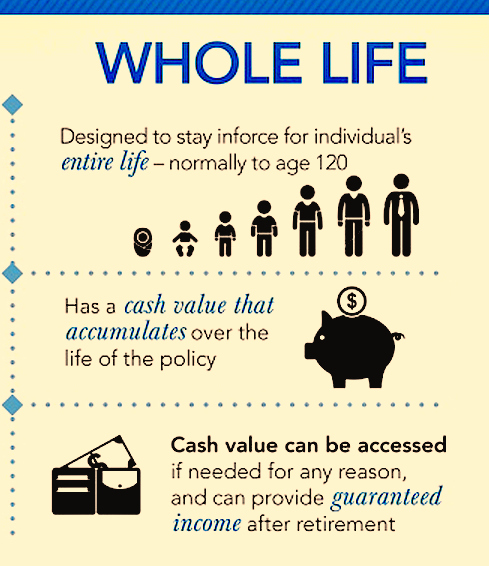

Whole life insurance offers permanent coverage that lasts for your entire lifetime. The main difference between whole life insurance and term life insurance is that whole life insurance builds cash value, which grows at a fixed interest rate. Once the cash value reaches a certain balance, you can withdraw some of the money and use it like a personal loan. In most cases, you can either repay the loan with interest, or as an alternative, the money will be deducted from the death benefit. Tata AIA Life onlineoffers a guaranteed1 return insurance plan that offers life cover, assured returns, tax benefits, unique riders, loan against policy and much more! ABSLI Life Shield offers joint life protection with your spouse and gives you the freedom to choose from 8 plan options and sum assured amounts .

The policy offers enhanced life stage protection, i.e, the plan provides additional cover during key stages of life like marriage, the birth of children. It also provides inbuilt Terminal Illness Benefit and Waiver of Premium Benefit in the event of critical illness and total permanent disability. Guaranteed Additions will accrue on a monthly basis to the policy on each policy month till maturity; provided all due premiums have been paid and shall be payable in event of death of life insured or policy maturity whichever is earlier. Guaranteed Additions per annum shall be determined based on the premium amount you commit to pay, premium band, sum assured, the entry Age of the life insured, Joint Life Protection option and policy term chosen. In case of Joint Life Protection option, the GuaranteedAdditions shall accrue on the sum assured applicable for the primary life insured and shall be payable on policy maturity. It is the simplest type of life insurance that provides financial safety to the life insureds family in case of the untimely demise.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.